san francisco sales tax rate 2018

Beginning January 1 2019 a number of tax law changes will become effective in the City of San Francisco the city. 250 for each 500 or portion thereof.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt.

. The County sales tax rate is 025. San Francisco CA Sales Tax Rate. San Geronimo CA Sales Tax Rate.

Historical Tax Rates in California Cities Counties. 8617 California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. A county-wide sales tax rate of 025 is applicable to localities in Santa Clara County in addition to the 6 California sales tax.

San Fernando CA Sales Tax Rate. 2 Page Note. The California sales tax rate is currently 6.

6 Average Sales Tax With Local. There are a total of 474 local tax. San Francisco Tax Update Overview Beginning January 1 2019 a number of tax law changes will become effective in the City of San.

7750 California City and County Sales and Use Tax Rates Rates Effective 10012017 through 03312018 2 P a g e Note. Free Unlimited Searches Try Now. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more.

Free Unlimited Searches Try Now. This rate is made up of a base rate of 6 plus a mandatory local rate of 125. Download tax rate tables by state or find rates for individual addresses.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. With the addition of locally approved county and municipal taxes the total combined sales tax. San Fernando Sales Tax Renewal.

A county-wide sales tax rate of 025 is. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a.

Ad Lookup State Sales Tax Rates By Zip. The San Francisco sales tax rate is 0. San Francisco 8625.

Ad Lookup State Sales Tax Rates By Zip. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. Did South Dakota v.

This scorecard presents timely. Wayfair Inc affect California. Two of these resulted from recent voter.

The Santa Clara County Sales Tax is 025. There is no applicable city tax. Proposition 172 1993 extended the state sales tax rate of 6 percent.

California City and County Sales and Use Tax Rates Rates Effective 04012018 through 06302018. San Gabriel CA Sales Tax Rate. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

More than 100 but less than or equal to 250000. Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62. Download tax rate tables by state or find rates for individual addresses.

Out in 2018 will remain in place at the rate of 038. 6 rows The San Francisco County Sales Tax is 025. 340 for each 500 or portion thereof.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. Next to city indicates incorporated city City Rate County. Next to city indicates incorporated city City Rate County.

More than 250000 but less than 1000000.

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

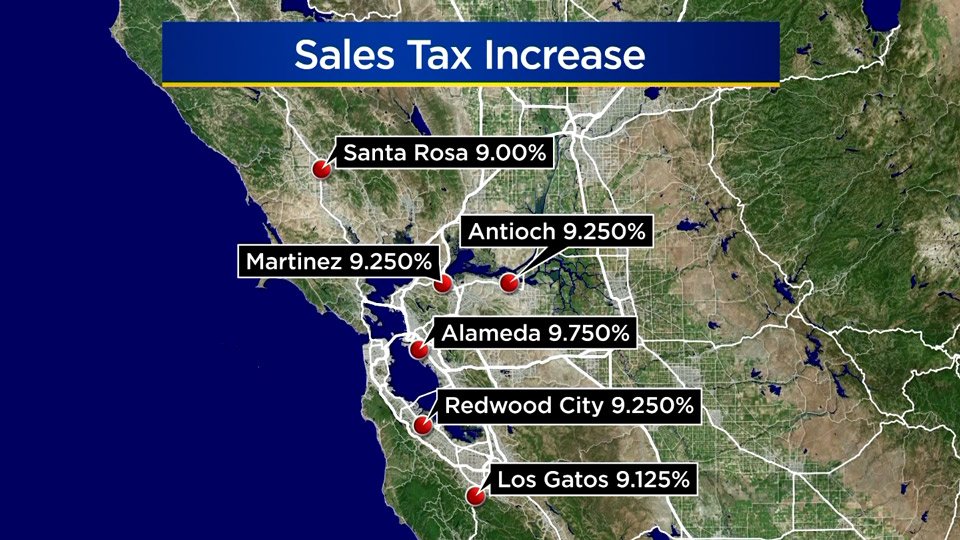

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco

What Are The State Income Tax Rates For California Quora

Sales Tax On Saas A Checklist State By State Guide For Startups

Report Nyc And San Francisco Local Taxes Are 6 Highest In The Country

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Frequently Asked Questions City Of Redwood City

Understanding Where California S Marijuana Tax Money Goes

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Sales Tax Collections City Performance Scorecards

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

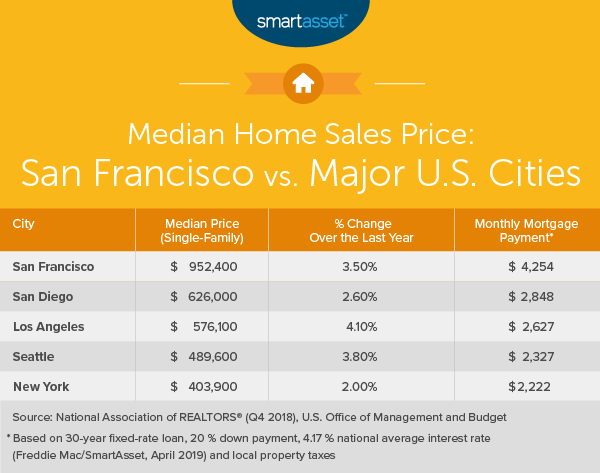

What Is The True Cost Of Living In San Francisco Smartasset

Do States Like New York And California Really Have High Taxes Quora

San Francisco Prop W Transfer Tax Spur

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Which States Have The Highest Income Tax Rates Fedsmith Com

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California State Sales Tax 2018 What You Need To Know Taxjar